How a Recession May Impact the Vintage Clothing Market

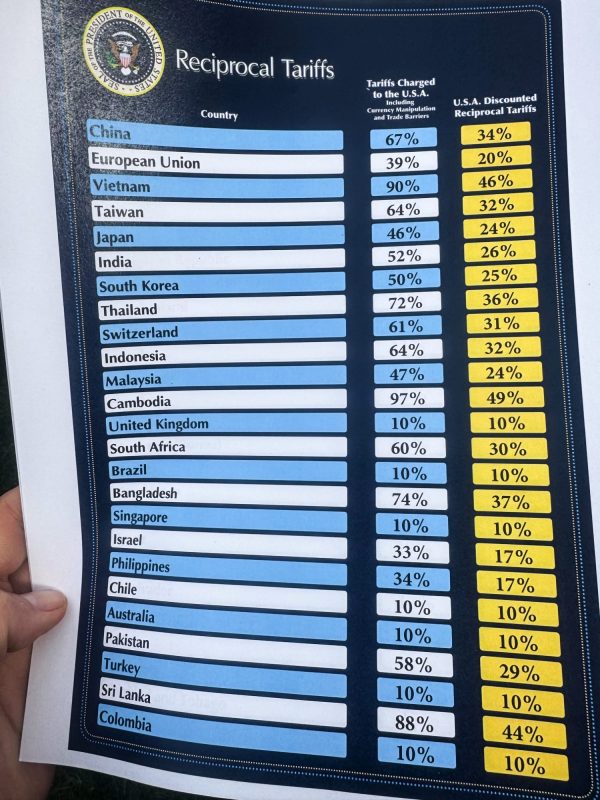

Last week Trump imposed sweeping Tariffs on almost every country on earth, sending the stock market tumbling and spiking tension with America’s trading partners. As a nearly unavoidable trade war looms and recession anxiety intensifies, shoppers are being forced to reconsider their buying habits—and there will be winners and losers in the used clothing market. Asset-class vintage will continue to hold its value, luxury-priced vintage will struggle to sell and entry-level vintage, especially Y2K and thrifted fashion, is poised to benefit.

Tariffs are taxes levied on foreign goods typically paid by a domestic importer at the port of entry. This means a higher landed cost of goods for businesses and in most cases a higher sticker price for customers. Tariffs are typically imposed as a trade barrier to make specific domestic industries viable, especially market segments essential for national security–think energy and manufacturing and technology necessary for defense. Tariffs have also been used as a measure against bad-faith trading partners whose unfair trade practices threaten domestic businesses for example China’s lax approach to intellectual property rights led to tariffs being levied against them in 2018.

Out of the list of tariffs Trump announced, two stand out as particularly impactful to the used clothing industry; a now 125% tariff on Chinese goods and a 24% tariff on Japan.

97% of clothing sold in the United States is imported with China producing the largest share of these goods. If these tariffs hold we could see massive jumps in the price of new clothing driving consumers to look for second-hand alternatives. This change in pricing and consumption may raise the price shoppers are willing to pay for a used option. The biggest winners here are thrift stores and volume-focused vintage stores whose cost of goods is so low that they can churn through inventory at low price points.

Historically the Japanese market has set the price for collectible American vintage clothing and though domestic interest has grown exponentially over the last two decades the best true vintage still ends up in Japan. Though Japan has not announced any retaliatory measures, tariffs are rarely left unanswered. If Japan levies tariffs against the US it will increase import costs for the Japanese. With the yen worth almost half what it was in 2011 against the dollar; Japanese buyers have already been pinched and these tariffs could push smaller vintage dealers over the edge. The biggest players in this space who can sit on inventory and have large bankrolls will continue to buy through the dip and take advantage of the current/upcoming market position. This will likely lead to a consolidation of high-end true vintage in a small number of collections as those with smaller pockets and less leeway are squeezed out.

Imported goods, particularly from major manufacturing hubs like China, are expected to drive up the cost of new clothing. At the same time, economic uncertainty is tightening wallets. As people pull back on discretionary spending, the demand for affordable fashion alternatives will rise. Thrifted and secondhand items, especially those with nostalgic or trend-driven appeal like Y2K pieces, are becoming go-to solutions for consumers who still want to express style without breaking the bank.

Asset class true vintage–think any Levi’s worth $1000 or more–will continue to be a good store of value and as long as it is available there will be someone to buy it. True vintage clothing (genuinely old items, usually 30-40+ years, and rare/desirable) is being treated like an asset class—like stocks, real estate, or gold. It’s something people can invest in.

This is unlikely to be the case for the high-end t-shirt market whose prices tend to be driven more by trends and domestic demand. These pieces are more luxury items than assets and a recession could shatter a market still shaking from the Disney tee crash. With the stock market reeling and more and more American companies announcing layoffs, demand for expensive graphic tees may reach a new low. The fact that these tees are often an overt display of wealth won’t help either. During times of economic hardship fashion often moves to more understated options, something all-over-print Marvel and Nascar shirts are not.

Discussion

Be the first to leave a comment